How to safegaurd your family’s asset? According to Inheritance Laws in

India.

In a world where wealth can shift hands unexpectedly, ensuring your family’s legacy remains intact is not just important—it’s crucial. Whether it’s your property, savings, or intellectual property, understanding inheritance laws in India is the key to a seamless transition of assets and securing your family’s wealth for generations. But there’s more to it than simply knowing the law—it’s about planning ahead and making sure your family is protected from the chaos of inheritance disputes. Dive into this guide to unlock the secrets of safeguarding your family's legacy.

1

Types of Assets Covered

Inheritance laws cover a range of assets, and each one has its own significance:

- Immovable property: Real estate, the heart of many Indian families' wealth.

- Movable assets: Bank accounts, stocks, jewelry—assets that are easy to transfer but often spark the most disputes.

- Intellectual property: The creative legacies like patents, copyrights, and trademarks that grow in value.

- Liabilities: Debts and loans that affect the overall estate value.

Did you know that 75% of families in India own real estate? Yet, 70% also face inheritance disputes. The question is—are you prepared?

2

Hindu Succession Act

The Hindu Succession Act might be the cornerstone of how inheritance works for millions in India, but it’s also a powerful tool for gender equity. It ensures that daughters have the same rights to ancestral property as sons. This change has helped reduce familial conflicts, promoting fairness in succession and inheritance rights across all generations. But it’s not just about equal rights—it’s about the right to ensure harmony.

3

Wills & Testamentary Succession

What’s the best way to ensure that your wishes are honored? It’s not a complicated legal battle; it’s about having a Will in place.

Creating a will isn’t just for the wealthy—it’s for anyone who wants their assets to be distributed without confusion or conflict. Key steps include:

- Choosing beneficiaries: Clear and unambiguous.

- Appointing an executor: A trusted individual who will execute your wishes.

- Understanding probate: The legal process that will ensure your will is executed properly.

And here’s a shocking statistic—60% of adults in India don’t have a will. Are you ready to leave your family vulnerable to potential disputes?

4

Resolving Disputes

Inheritance disputes are emotionally and financially draining. The solution? Prevention through clear communication. Share your plans, communicate openly, and if conflict arises, consider alternative dispute resolution like mediation. When everyone knows where they stand, harmony is restored. But if left unchecked, these disputes can lead to legal nightmares.

5

Tax Considerations

When you inherit assets, you may think you’re free from taxes. But think again—capital gains tax and income tax can sneak up on heirs, especially when inherited property is sold or generates income.

Understanding these tax implications can help your heirs manage their wealth more effectively, reducing unexpected financial burdens. Planning for tax liabilities is just as important as the inheritance itself.

6

Professional Assistance

Navigating inheritance laws and crafting a solid estate plan is no small task. That’s where professional expertise comes in. FBTM can help tailor an estate plan that is specific to your family’s needs, ensuring your wealth is distributed according to your exact wishes.

The real value lies in proactive estate planning—not only ensuring that your assets are protected but that your family’s future is secure. Don’t wait for a crisis to act; start planning today.

Contact us to learn more

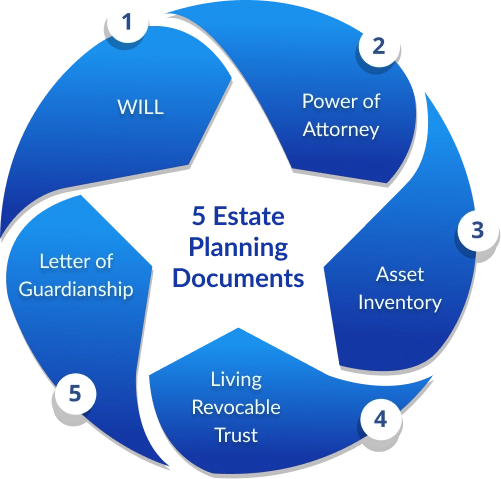

What Exactly Is an Estate Plan?

- Will

- Power of Attorney

- Asset Inventory

An estate plan is more than just a set of documents. It’s a roadmap to ensure that your family’s financial future is stable, even in your absence. With a comprehensive estate plan, you’re not just distributing wealth—you’re taking control of your legacy.

An Estate Plan allows you to:

- Designate a Trusted Decision-Maker: Choose someone who will make important

decisions

on your behalf if you become incapacitated, ensuring your wishes are honored.

- Ensure Care for Your Children: Specify who will care for your minor children

or

specially-abled child if you’re unable to do so, providing peace of mind during

difficult times.

Estate Planning is about control:

"Creating an estate plan empowers you to dictate how your assets are managed and

distributed, ensuring that your well-being is prioritized as you age or in case of

illness. Research indicates that over 60% of adults lack a will, leaving families to

navigate complex legal issues during grief.

Without a plan, the court decides who becomes the guardian of your children and how your

assets are allocated—decisions that could differ from your wishes."

Who needs Estate Planning?

At FBTM, we understand that estate planning is crucial for everyone, and it can be tailored to

fit various life situations in the Indian context:

- Are you single? Even at this stage, a simple Financial Power of Attorney and a Pour-Over Will can ensure your wishes are honored.

- Married? Mirror Wills ensure that both partners' wishes align in the event of tragedy.

- Parents? A Letter of Guardianship ensures your children are cared for by someone you trust, even if you are no longer there.

- Wealthy or Business Owner? Create trusts and plan for business succession to protect your wealth for future generations.

Estate Planning

FBTM offers comprehensive services to help you create an estate plan that meets your needs:

- Drafting your will in accordance with the Indian Succession Act.

Appointing Testamentary Guardians to care for your children.

Establishing various trusts, including Hindu Undivided Family (HUF) trusts, special needs

trusts, and charitable trusts.

- Setting up Powers of Attorney for situations where you may become incapacitated.

- Planning for business succession to ensure a smooth transition of family-owned businesses.

- We also assist you in adapting your estate plan as your circumstances change, ensuring your

strategies align with your evolving goals.

Common Issues Faced by Heirs in India

Heirs in India may encounter several challenges when managing an estate:

- Property Disputes: Conflicts over the distribution of property can lead to

lengthy legal battles, often exacerbated by differing interpretations of Hindu succession

laws or Muslim personal laws.

- Distance Challenges: Heirs living abroad, particularly Non-Resident Indians

(NRIs), may find it difficult to manage assets or complete formalities from afar.

Complex Documentation: Obtaining legal documents, such as succession certificates or

property transfer papers, can be cumbersome and may require physical presence.

- Lack of Awareness: Heirs might be unaware of their parents' movable assets like

bank deposits, shares, or insurance policies, leading to delays and potential tax

implications.

- Tax Liabilities: While inheritance itself is not taxed, any income generated

from inherited assets or the sale proceeds can attract tax liabilities, especially for NRIs.

Special Needs or Minor Heirs: Beneficiaries with special needs or minors require careful planning

to ensure their inheritance is managed responsibly.

At FBTM, we are dedicated to helping you and your family navigate these complexities with

empathy and expertise. For more information about our services, visit

Contact us to learn more

info@fbtm.in

info@fbtm.in +91 98111 63422

+91 98111 63422

Other Services

Other Services